How do you describe what it is that you do? When a potential client searches for an agency or encounters your business through a directory, referral platform or search result, what do they see first? Often it is your meta description, those crucial 150-160 characters that distill your entire proposition into a discoverable and compelling summary. Does yours? When was the last time you checked? Because it is important: this isn’t marketing copy buried deep on your About Us page, it’s the sign hanging above your virtual front door. And it determines whether someone clicks through or scrolls past.

This analysis, a collaboration between Agency by Agency and Treacle, examines the language used in the meta descriptions of over 25,000 agencies in the UK. Far from being a peripheral concern, these descriptions not only represent something fundamental in how agencies choose to position themselves, but they also help us understand what we have called the language trap: namely, if everyone sounds the same, how can anyone stand out?

Your description is your proposition, what you choose to emphasise when space and attention is limited. And if an agency can’t articulate its value in this context, how effectively can it differentiate anywhere else? What emerges when we explore the agency language trap is a picture of widespread linguistic sameness, which may be undermining the very differentiation you are seeking to achieve.

The saturation problem

Agency emphasis

We first tested the meta descriptions of all agencies in the sector against a selected set of agency-centric keywords to explore saturation, with some interesting findings.

Agency emphasis – all agencies

About the data

Our partners at The Data City provide us with data for the meta descriptions of all agencies we have mapped.

When nearly a third of all agencies describe themselves using some form of “creative” in their language, the term potentially loses its power to differentiate. Our analysis reveals that 32% of UK agencies deploy creative terminology in their meta descriptions, which may indeed work against the very differentiation these agencies seek.

The potential saturation problem extends beyond creativity. Almost a quarter of all agencies claim to be “award-winning”, with 23% using accolades as their primary positioning device. This raises important questions about the value of such claims when they become so commonplace. If everyone is award-winning, does anyone stand out?

Client-centric language presents another area of oversaturation, especially if we cluster the use of different terms that speak to the same subject. Terms like “clients”, “partners”, “extension of your team” and “trusted” when measured together appear in the descriptions of 26% of agencies. While demonstrating client focus is undoubtedly important, when more than one in four agencies make similar claims, the language becomes background noise rather than a compelling differentiator.

“The data doesn’t lie. The agency market’s saturated with the same vague claims and empty clichés. Those awards you won look all shiny on your shelf, but so do the others on 23% of agency shelves. Today, this isn’t enough to set you apart so dialling it up in your messaging isn’t having much impact.

Same for being ‘client-centric’. Who out there is claiming the opposite? Nobody’s shouting about how they put their agency’s needs above their clients. That’s because client centricity is expected from an agency. In fact, it’s the reason agencies exist.

The problem isn’t just an overuse of the same words. It’s that most outfits are competing on the same ideas agencies have traded on for decades. As the market fragments and specialist shops start to steal your lunch, you need to fight smarter by talking about specific, tangible and valuable points of difference.

Your biggest competitor right now isn’t that agency down the road, or the big network players. It’s the onslaught of averageness where you look, sound and feel like everyone else. From a prospect’s point of view, most agencies are indistinguishable and interchangeable.

However much being ‘passionate’ is true, even if you really do work with ‘ambitious brands’, the market demands more right now. Brands are seeking out genuine specialists, buying programs and products over laundry lists of services, and connecting with those who have something new to say.

Today, the grey middle ground is where great agencies go to die.”Roland Gurney, Treacle

The twenty most commonly used words

Our next step in the analysis was to explore the twenty most commonly used words across all agency descriptions. One of the first observations that jumped out at us, was the fact that only two thirds of all agencies actually use the word “agency” in their core proposition.

| Word | Agencies using | % of agencies using |

|---|---|---|

| agency | 16946 | 66% |

| marketing | 16011 | 63% |

| digital | 13826 | 54% |

| design | 12185 | 48% |

| based | 7043 | 28% |

| web | 6997 | 27% |

| creative | 6910 | 27% |

| services | 6340 | 25% |

| company | 6233 | 24% |

| business | 5723 | 22% |

| brand | 5012 | 20% |

| media | 4850 | 19% |

| seo | 4632 | 18% |

| development | 4544 | 18% |

| website | 4428 | 17% |

| brands | 4294 | 17% |

| social | 3943 | 15% |

| help | 3912 | 15% |

| london | 3870 | 15% |

About the data

Our partners at The Data City provide us with data for the meta descriptions of all agencies we have mapped.

In general, generic terms dominate the list, with “marketing” appearing in 63% of agency descriptions and “digital” in 54%. These functional descriptors tell potential clients what category of service provider agencies are, but they say nothing about why they should choose an agency over the thousands of others using identical terminology.

Even location-based differentiation shows saturation effects, with “London” appearing in 15% of all agency descriptions. In our Agency by Agency Industry Report (Spring 2025), we reported that 30.3% of all agencies are based in the capital, which would suggest that approximately half of all agencies in London are mentioning their location in their meta descriptions.

While geographic positioning can be valuable, its widespread use suggests that many agencies may be defaulting to location rather than developing more distinctive value propositions.

About the data

Our partners at The Data City provide us with data for the meta descriptions of all agencies we have mapped.

Specialism-specific patterns reveal fresh opportunities

Agency by Agency have currently mapped 29 specialisms within the UK agency sector as a whole, based on what agencies do. It is important to note that any individual agency may appear in our mapping across a number of different specialisms, but that when we analyse the agency landscape as a whole, they are of course only ever counted once.

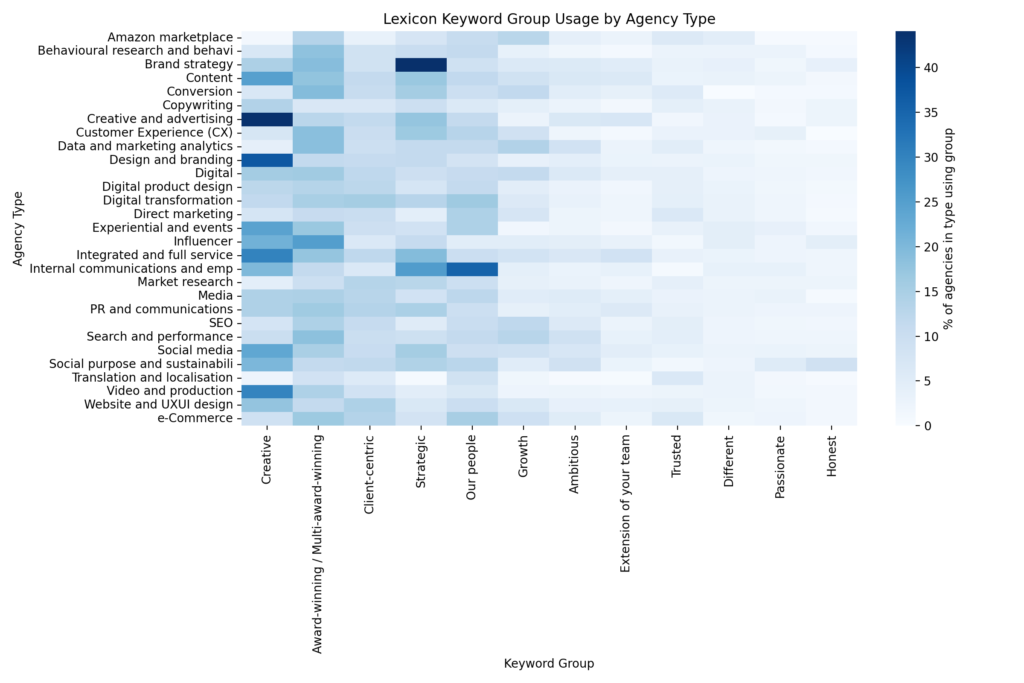

Applying our language analysis to the 29 specialism groupings allows us to explore the patterns that emerge via Term Frequency-Inverse Document Frequency, which in turn shows us which specialisms are more likely to use which terms. In the following chart, the rows = agency subsectors and the columns = keyword groups. The colours are based on the percentage of agencies within that category whose description contains any terms from the group. The deeper the colour, the higher the density of word usage:

About the data

We map the number of agencies in the UK agency sector together with our partners at The Data City, whose sophisticated machine-learning tool allows us to find and categorise active agencies after adjustment for dormant companies and those in liquidation or administration. Depending on the individual agency and the services they offer, agencies can appear in more than one of our subsector or specialism lists.

Our partners at The Data City provide us with data for the meta descriptions of all agencies we have mapped.

Examining language usage by specialism reveals both predictable patterns and surprising opportunities for differentiation. Creative and advertising agencies, design and branding specialists, digital agencies and content creators show the highest concentration of “creative” language, with between 20% and 30% of agencies in these categories using such terminology.

This confirms what many might have suspected: the word “creative” has become commoditised within creative disciplines.

Award-winning language shows interesting specialism variations. Media agencies lead the pack, with 25% claiming awards, followed closely by PR and communications at 24%, content agencies at 22% and integrated agencies at 18%. This clustering suggests that certain sectors view credentials as particularly important positioning tools, but it also reveals opportunities for agencies to differentiate through alternative approaches.

Strategic language offers one of the clearest differentiation opportunities. While 44% of brand strategy agencies naturally use strategic terminology, most other subsectors remain in single digits for strategic positioning. This presents a significant opportunity for agencies in non-strategy disciplines to differentiate by emphasising their strategic thinking and planning capabilities.

Technical performance agencies demonstrate notably different language patterns. SEO, search and performance, and data analytics agencies rely more heavily on “growth”, “trusted” and “ambitious” vocabulary than on “creative” descriptors. This suggests these subsectors have developed their own linguistic conventions, creating clearer differentiation from creative-focused competitors.

Behavioural research agencies show perhaps the most distinctive language profile, under-indexing on “growth” and “ambitious” terminology while over-indexing on “our people” language. This human-centric positioning reflects their discipline’s focus on understanding rather than optimising, suggesting that aligning language with core methodology can create genuine differentiation.

“Strategy: valuable for clients, profitable for agencies. But most give it away as a gateway to selling execution. Lots of agency leaders mistakenly see strategy as an abstract and academic exercise, so they either skip it entirely or reluctantly add it as a loose line item. But strategy is the smartest thing to sell right now.

It’s bread-and-butter to brand agencies but other sectors are missing out. Having worked with hundreds of agencies across the world, we’ve seen the smart, strategic thinking that happens naturally inside 99% of operations. But there’s a fear or a resistance to making it a compulsory starting point and a sellable phase.

Strategy is often what separates smaller shops from the upstream ones. It’s what bigger brands want and need. And it doesn’t need to be difficult. Essentially, it’s asking smart questions and guiding clients to decisions. It’s a process of helping them find their focus, whatever discipline you work in.

The more process you create around it, the happier teams will be to deliver it. You can then explain how it works and sell what clients get from it. Start with a lightweight strategy process; a workshop or a handful of exercises. Think of it as an MVP that you build out over time. Begin with some discovery and research, analyse the important gaps, then create clever ways to get clients to make big calls on how to overcome these.

And stop giving strategy away for free. Sell your brains, not just your hands.Roland Gurney, Treacle

Size and maturity effects

Applying the Term Frequency-Inverse Document Frequency to agency size and maturity means we can explore other ways in which language usage differs across the UK agency sector.

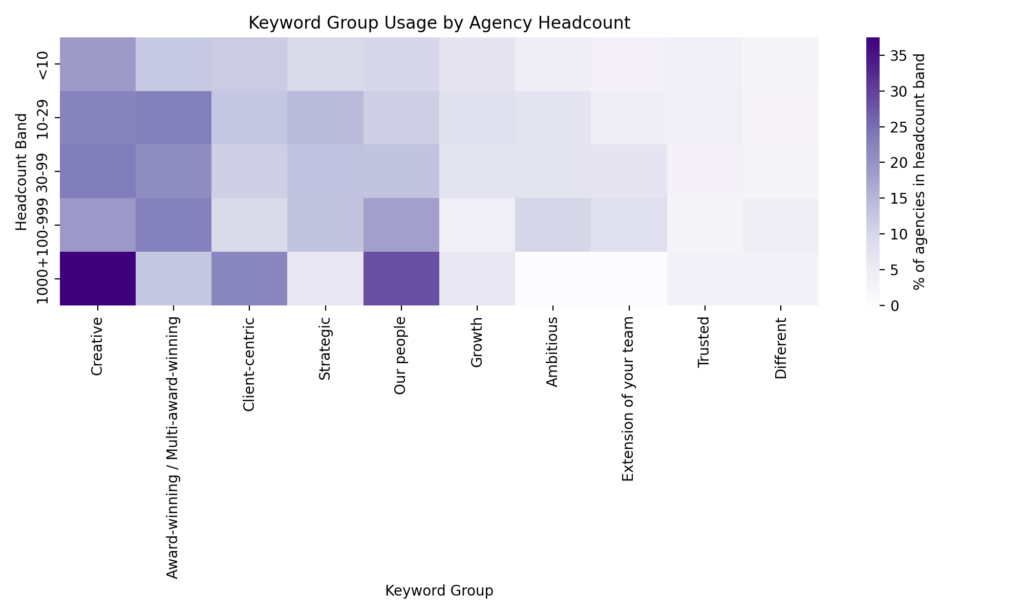

Agency size

For agency size, we applied the language analysis to agency groupings based on headcount. The rows = agency size intervals and the columns = keyword groups. The colours are based on the percentage of agencies within that size interval whose description contains any terms from the group. The deeper the colour, the higher the density of word usage:

About the data

Data for employees / headcount is provided by our partners at The Data City based on reporting to Companies House. As there can be a lag in reporting, The Data City’s machine-learning platform can make an accurate best estimate. If an agency has less than three years reported data on employee number, no estimate is made and no data is reported.

Our partners at The Data City provide us with data for the meta descriptions of all agencies we have mapped.

Agency size creates distinct linguistic patterns that reveal how positioning evolves with scale. Smaller agencies with fewer than ten staff already demonstrate significant use of “creative” language at 19%, but show notably less reliance on “award-winning” positioning compared to larger competitors. This suggests smaller agencies may be competing more on capability and approach than on established credentials.

Mid-sized boutique agencies, those with between 10 and 99 employees, emerge as the most vocal about awards, with roughly one-fifth using “award-winning” terminology. This positioning may reflect their need to establish credibility while competing against both smaller specialists and larger full-service providers. For these agencies, credentials serve as a bridge between scrappy startup energy and established player authority.

Larger agencies with over 100 employees shift their language emphasis notably. They increase their use of “our people” language to 18% and “ambitious” positioning to 10%, while simultaneously toning down “growth” claims. This pattern suggests that results become expected rather than advertised as agencies mature and scale. The largest agencies lean most heavily on “creative” positioning at 38% and people-focused language at 28%, while rarely mentioning “extension of your team” or growth promises.

“Big agencies have a gravitational pull. They trade on reputation and team size to land clients. So it makes sense they lean on people-centric language, scale cues and creative credentials to reinforce their status. At that level, results are assumed and the story becomes about capability, stability and culture.

Smaller agencies have to fight smarter. The traditional play is to emphasise how being leaner creates a direct line between client and team so creativity happens without bureaucracy. But this is now the norm, not the exception. The real differentiators come from sharper niches, clearer offers and stronger IP that show depth rather than size.

Mid-sized agencies sit in the tension between the two. They often rely on awards and credibility cues to bridge the gap. Yet the agencies that break out do it by owning a specific market, problem or approach rather than trying to look big or act small.”Roland Gurney, Treacle

Agency age

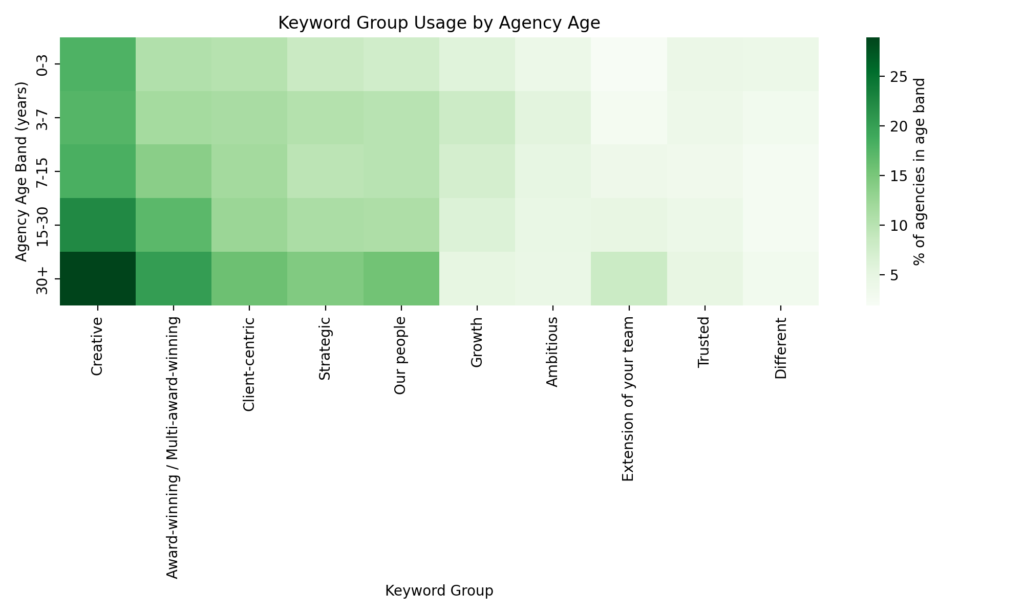

For agency age, we applied the language analysis to agency groupings based on year of company founding. The rows = agency age intervals and the columns = keyword groups. The colours are based on the percentage of agencies within that age interval whose description contains any terms from the group. The deeper the colour, the higher the density of word usage:

About the data

We map the number of agencies in the UK agency sector together with our partners at The Data City, whose sophisticated machine-learning tool allows us to find and categorise active agencies after adjustment for dormant companies and those in liquidation or administration.

Our data on agency age is based on company births and deaths, as registered with Companies House.

Our partners at The Data City provide us with data for the meta descriptions of all agencies we have mapped.

Agency age reveals equally compelling patterns about linguistic evolution. “Creative” and “award-winning” language rises steadily with agency maturity. While fewer than one in five newly founded agencies use “award-winning” positioning, the figure climbs above 20% for agencies older than thirty years. This suggests that established agencies increasingly lean on legacy credibility signals, potentially including awards won years or even decades ago.

Strategic language shows a similar trajectory, jumping from about 8% among the youngest agencies to more than 14% among the oldest. This evolution may reflect a natural progression from executional positioning in early years to advisory positioning as agencies develop expertise and market standing.

Interestingly, growth-obsessed vocabulary peaks among middle-aged agencies in the 3-7 year window, reaching 8% usage. These agencies, established during challenging economic conditions, may be more explicitly focused on demonstrating their ability to drive client results. People-centric language follows a U-shaped pattern, starting high among new agencies, dropping during scaling years, then climbing again among mature firms as culture becomes a key selling point once growth stabilises.

The challenge of differentiation

The patterns that have emerged in the analysis of agency descriptions reveal a fundamental challenge facing the agency sector: how to achieve differentiation when linguistic conventions push toward conformity. The data suggests that many agencies may be inadvertently undermining their own positioning by defaulting to sector-standard terminology rather than developing distinctive value propositions.

The prevalence of generic terms like “creative”, “award-winning”, and “trusted” creates a linguistic landscape where genuine differentiators become buried in background noise. When potential clients encounter dozens of agencies claiming similar attributes, these descriptors cease to influence decision-making and may actually work against agencies seeking to establish distinctive market positions.

Yet the data also reveals significant opportunities for agencies willing to break from conventional positioning. The relative rarity of strategic language outside brand strategy agencies suggests unexploited potential for agencies to differentiate through strategic positioning. Similarly, the concentration of growth-focused language in performance disciplines creates opportunities for agencies in other sectors to emphasise results and business impact.

The size and maturity patterns indicate that agencies may be missing opportunities to align their language with their actual competitive advantages. Micro-agencies might better leverage their agility and fresh thinking rather than competing on creative credentials. Mid-sized agencies could emphasise their optimal balance of capability and accessibility. Large agencies might focus on their unique ability to deliver complex, multi-faceted solutions rather than generic creative claims.

“Look, we’ve been banging the drum about beige agency-speak for years, but now the data shows we’re not just shouting for no reason. The over-reliance on the same terms and selling points is forming a mush of ‘creative and award-winning’ digital marketing agencies who leave prospects baffled at best, and at worst crying into their coffees.

The solution is to rethink what differentiation is. Of course, you need great case studies, lovely people and to help clients grow. But today these aren’t enough to become the obvious choice. It’s a fight to even get noticed above the noise, let alone being chosen ahead of the thousands of others who do the same thing as you.

Agency positioning is a book in itself, often full of convoluted jargon and confusing BrandNonsense™ bullshit. So let’s keep it simple and look at three fundamental areas:

1. WHO you target

The first fundamental to consider is your target client. Aiming for ‘ambitious brands’ or ‘tomorrow’s leaders’ helps nobody. The aim is to narrow down to one specific client type. At its most extreme is niching; focusing on one specific client (often by industry). As with all strategies, this comes with risks and rewards. A niche focus limits your total market but it makes you the obvious choice because you can build compound expertise in their sector, not just yours. Beyond full niching, you can narrow to define one specific client type by size, stage or common situation.

Once you have a clear and defined target client, you need to work out what problem they need solving that means they need an agency. Don’t fall for something generic like ‘growing my business’ or ‘making more revenue’. These are universal and unspecific. You’re looking for that specific issue that most prospects mention. That barrier or blocker that prevents them from growth, revenue, sales or whatever.

2. WHAT you do for them

Once you know exactly who you’re for, the next step is defining what you actually do for them. This goes beyond an endless list of services. Clients want you to have a specific way to solve their problem, not just a menu of stuff.

Your WHAT can take several forms. It might be core services delivered by your team. It could be named programs that bundle your services into a structured, transformational journey. It might include products or packages with fixed timings and clear deliverables. Or it might be your platform(s), using software or proprietary tools to automate, analyse or power part of your solution.

Whatever the format, the aim is the same: turn your capabilities into something simple, structured and buyable. Something a client can grasp immediately and say, “That’s exactly what we need.”

3. HOW you go about it

The final step is showing how you deliver your work in a way that feels robust, repeatable and uniquely yours. Clients want to know there’s a proven method behind the outcomes you promise, not a loose collection of tactics or ad-hoc thinking.

This is where delivery IP comes in. Your approach should feel structured enough to trust, flexible enough to apply, and distinctive enough to own. That might be a named methodology, a phased framework, a set of guiding principles or a repeatable process that underpins every engagement.

Strong delivery IP turns your expertise into something dependable. It shows that results aren’t left to chance, but come from a deliberate, practised way of working. When clients can see the rigour behind your thinking, your HOW becomes a reason to choose you, not just a reassurance that you can deliver.

In the end, all of this comes back to the same problem: most agency messaging is built on clichés instead of clarity. When everyone leans on the same tired language about creativity, passion or award-winning work, nothing stands out and nothing sticks. The real shift happens when your WHO, WHAT and HOW give you something specific to say.

A defined audience sharpens your relevance. A structured, buyable offer gives you a concrete story to tell. Delivery IP gives you the proof and confidence to back it up. Put together, these elements replace beige generalities with a message that’s clear, focused and unmistakably yours. That’s how you stop sounding like every other agency and start becoming the obvious choice.Roland Gurney, Treacle

What questions should agencies be asking?

This analysis raises several critical questions that every agency should consider when evaluating their own positioning and language choices.

- How distinctive is your meta description when compared to others in your subsector and size category? If you removed your agency name from your description, would potential clients be able to identify what makes you different from your competitors?

- Are you defaulting to sector-standard terminology like “creative”, “award-winning” or “trusted” when you could be emphasising more distinctive capabilities or approaches? What would happen if you eliminated the three most common words from your current description and rebuilt it around your genuine differentiators?

- Does your language align with your competitive advantages, or are you using positioning that worked for your agency five years ago but no longer reflects your evolved capabilities? If you’re a mature agency leaning on decades-old awards, what recent achievements or capabilities might provide more compelling positioning?

- Are there opportunities in adjacent sectors’ language that could help differentiate your offering? Could a design agency benefit from strategic positioning, or might a digital agency stand out by emphasising their people-centric approach?

Most fundamentally, when someone encounters your description alongside five competitors, what specific reason are you giving them to choose you? If the answer isn’t immediately clear from your current language, the data suggests you may be caught in the same trap as thousands of other agencies; saying the same things everyone else says while wondering why it is hard to stand out from the crowd.

The language trap is real, but it’s not inevitable. The agencies that break free are those willing to move beyond sector conventions and embrace positioning that reflects their genuine competitive advantages rather than their industry category.

If there’s one lesson in this data, it’s that the agencies who win aren’t the ones shouting the loudest. They’re the ones who know exactly who they’re for, what problem they solve and how to say it in language that feels unmistakably theirs. That’s the core of our work at Treacle. We help agencies move away from generic claims and towards sharper positioning, clearer stories and offers clients actually want to buy.

Our ethos is simple. Don’t guess. Don’t follow the herd. Don’t assume creativity alone will carry you. Instead, build your brand on evidence, focus and proof. That’s why we created Pinpoint™, our four-week program that tests your new positioning and messaging before you go all in. Rather than spending months on a new website, proposition or rebrand, Pinpoint™ gives you a clear ICP, a defined offer, a focused page and real-world feedback so you know what truly resonates. It’s positioning with less risk and more reality.Roland Gurney, Treacle

About Treacle

![]()

Treacle have helped reposition hundreds of agencies worldwide, from boutique specialists to global players. Whether they’re pivoting into a niche, launching a new offer or trying to cut through a crowded market, the result is the same: greater clarity, stronger differentiation and a brand that feels like the obvious choice. If this analysis has you wondering whether your own positioning is helping you stand out or holding you back, it might be time to do the hard yards. And if you have any questions, just drop them a line at hello@treacle.agency.

About Agency by Agency

With our comprehensive mapping of more than 25,000 agencies in the UK across seven subsectors and 29 specialisms, Agency by Agency provides data and insight on the agency sector to inform strategy and policy, help investors, M&A teams and brands find the right agency, and gives all who are connected with the agency sector the possibility to break through the noise and find out what is really going on.

If you would like to receive regular updates and insight from our mapping, sign up for our newsletter and if you think we can help you find the right agency or would like specific data and insight for your own needs, get in touch.

Photo credit: Amador Loureiro on Unsplash